31+ how to calculate excess return

Web The riskless rate on T-Bills was only 3 so to calculate the excess returns enjoyed by investors in Big Blue she uses this formula. Web Online finance calculator to calculate active return excess return to that segment of the returns in an investment portfolio.

Solved Compute The Expected Excess Return Of The Market Chegg Com

Web How do you calculate the rate of return with our calculator.

. In order to perform a robust analysis on your portfolio returns you must first subtract the risk-free rate of return from your portfolio returns. Web How do you calculate excess return. Excess returns Returns on an investment.

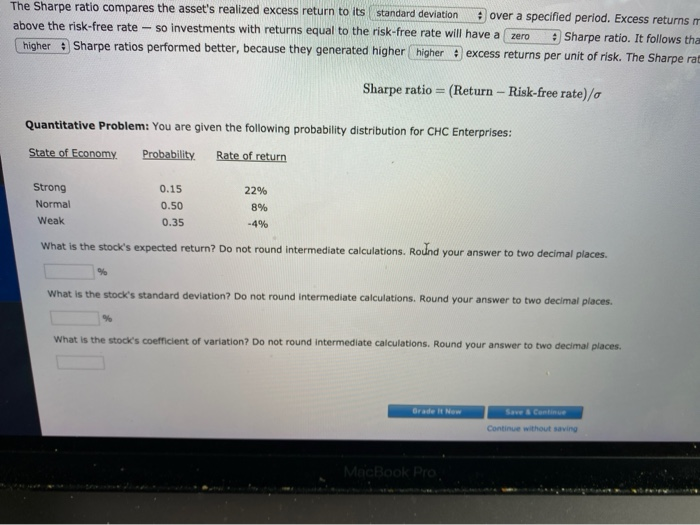

As you might recall from the video the Sharpe Ratio is an important metric that. To take a simple case compare an SP 500 index mutual funds total returns to the SP 500. Hello Im a finance student and am trying to create a template for.

Ln rate100 1 52. Web Rx Expected portfolio return. Web first I calculated the returns with ln priceprice on previous week then I did this with the 3M T-bill rate.

Web Mathematically speaking excess return is the rate of return that exceeds what was expected or predicted by models like the capital asset pricing model CAPM. In this case when you set 100000 as an initial investment and -12000 for the periodic withdrawals. StdDev Rx Standard deviation of portfolio return or volatility Sharpe Ratio Grading Thresholds.

Rf Risk-free rate of return. I divided the rate by 100 because it. Calculate average returns for both the long.

It can be calculated Return of Portfolio. Web Average return used in Sharpe Ratio and found in your performance page is your average daily returns. Web Help with formula that calculates average monthly excess return of series of returns in Excel.

Web Up to 25 cash back The annual rate is used to estimate a yearly return and is very useful for forecasting. Web Calculating the excess returns for an index fund is easy. Each day we record your portfolio value the change from.

Calculate the long short return by adding them together. In order to calculate excess returns subtract the returns on a risk-free investment from the returns on an investment and that. If you want to cover day 1 open to day 3 close the -022 is correct.

Web Up to 25 cash back Excess returns. Web Calculate excess returns for the long and short portfolio separately. Web This is why you get different returns by adding the return of the three days from taking the whole span.

Innovative Native Ms Methodologies For Antibody Drug Conjugate Characterization High Resolution Native Ms And Im Ms For Average Dar And Dar Distribution Assessment Analytical Chemistry

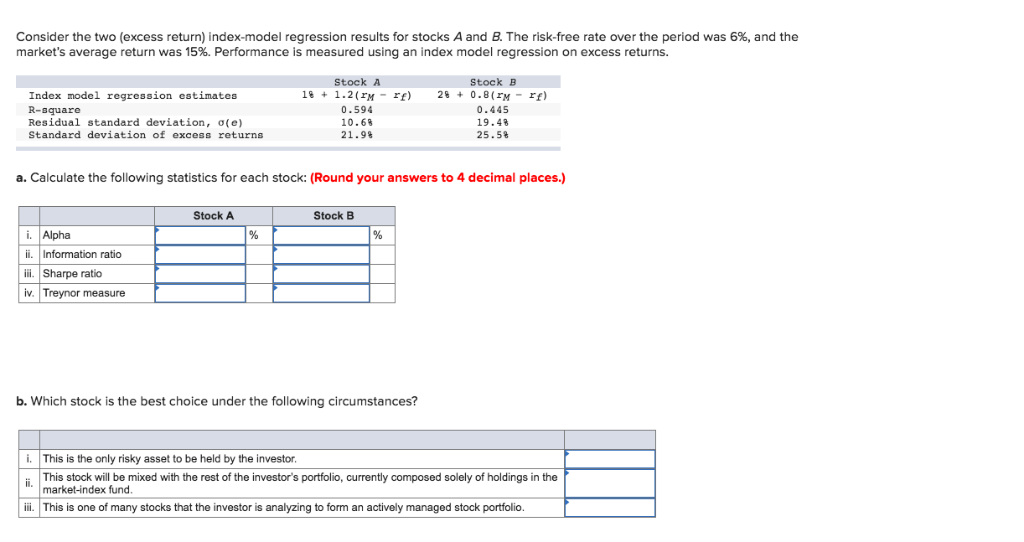

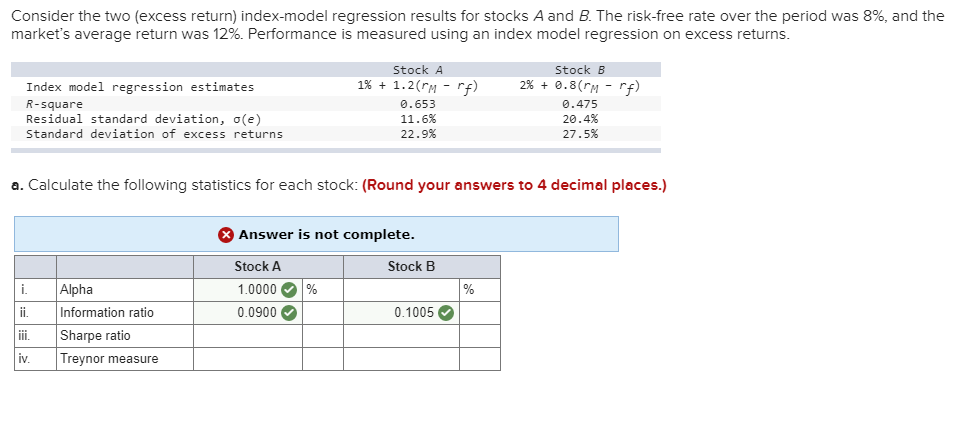

Solved Consider The Two Excess Return Index Model Chegg Com

Risk Free Portofolio Optimal Menghitung Excess Return M Jurnal

Excess Return Overview Formula Excess Return Calculation Study Com

Tips Ladder Spreadsheets In General Two In Particular Bogleheads Org

How To Calculate Excess Returns Sapling

What Are Average Excess Returns Equitysim

How To Excess Return Model For Valuing Financial Stocks

Excess Return Finance Reference

How To Excess Return Model For Valuing Financial Stocks

Excess Return Eva Data Guide To Spreadsheet Youtube

Step 6 How To Calculate Excess Return Formula In Ms Excel Youtube

Solved The Sharpe Ratio Compares The Asset S Realized Excess Chegg Com

Consider The Two Excess Return Index Model Chegg Com

Final Directtaxlaw Practice Pdf Income Tax Tax Deduction

G201504061231506732618 Jpg

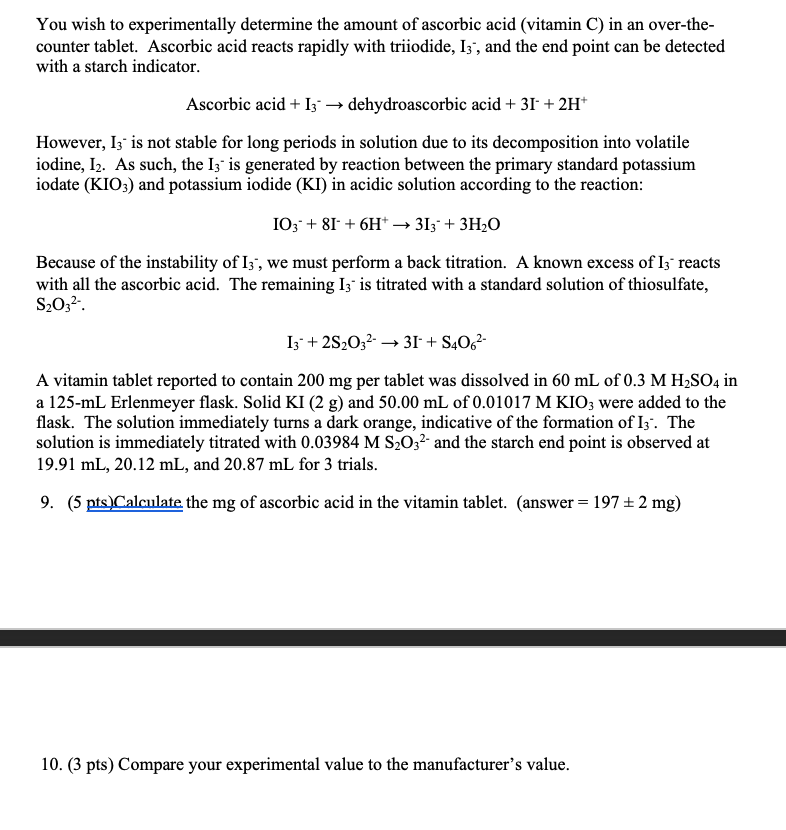

Solved You Wish To Experimentally Determine The Amount Of Chegg Com